IFTA Creation

$480.00 Only

$480.00$480.00 Only

Product Code: 137

Product Description:

IFTA tax returns can be created and organized to maintain your mileage records and fuel purchases Fuel Tax Agreement.

We explains exactly how to file your IFTA return before IFTA is created for truckers and companies.

(IFTA) was created to facilitate the process of calculating fuel taxes. This must be updated quarterly after creation is done.

Fuel Tax Agreement, was created to streamline the collection & distribution of fuel taxes for carriers who operate.

IFTA Creation

Our third-party IFTA creation services will generate IFTA files in any state(s). This way, you can receive stickers and pay your fuel taxes with ease. We’re standing by right now to help you establish an official IFTA account. Please read the information below to learn the basics about IFTA. If you have questions, do not hesitate to contact our organization.

What Is IFTA?

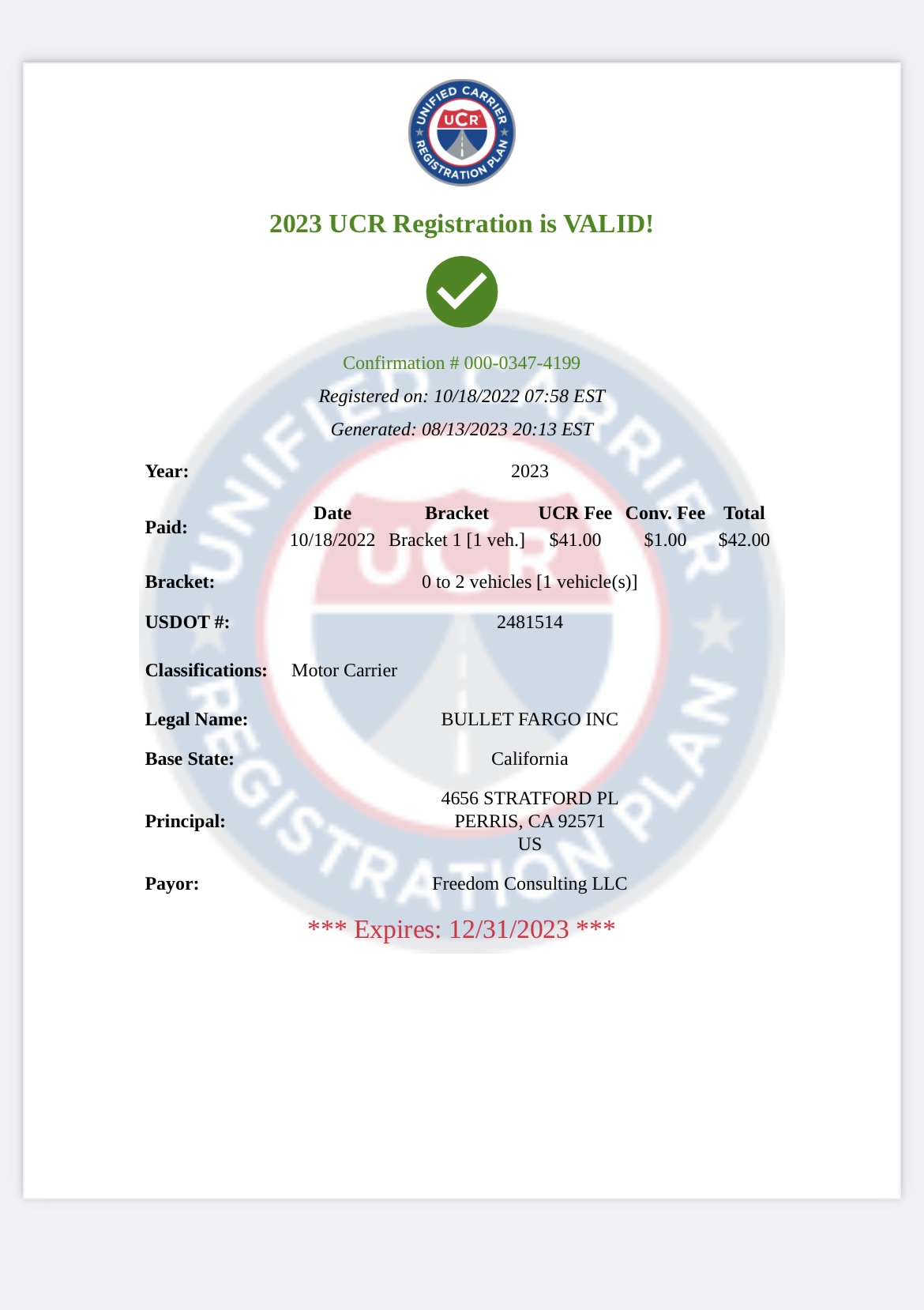

“ITA” stands for: International Fuel Tax Agreement. It functions as an official agreement between the USA and provinces in Canada. The purpose of IFTA is to simplify fuel use reporting by commercial motor carriers. IFTA policies concentrate on only the carriers that operate in more than one state. That's why Hawaii, Alaska, and some Canadian territories do not take part in IFTA.

Say that your carrier becomes registered with IFTA through our creation services. This means that you will receive an official IFTA license. Plus, you'll also get two decals per registered vehicle. The key is for your carrier to file a fuel tax report every single quarter. A report will determine the refund or net tax totals. Then, the government will redistribute tax money from collecting states to others.

When Is an IFTA Report Due?

Every IFTA report becomes due at the end of each quarter during an entire year. But the government will grant you an extra month after each quarter. This period refers to the deadline month. Then, a carrier has no choice but to file a quarterly report. Here is an example of how IFTA filing processes function. Say that you need to file for the first quarter of the year. That quarter includes January, February, and March. The government will allow you to wait until the conclusion of April to file. This means that you will not receive a late penalty for filing in April.

Does My Truck/Vehicle Need IFTA Registration?

Let’s now go over criteria related to which vehicles need IFTA registration. IFTA is for all sorts of commercial vehicles that move from state to state. These vehicles transport either people or property. A vehicle must have IFTA registration if it has two axles. Plus, if the vehicle features a gross weight over at least 26,000 pounds. Every three-axle vehicle must have active IFTA registration. Also, even a gross combination weight of 26,000+ pounds leads to registering for IFTA. “Gross combination” often refers to a vehicle that's pulling a trailer.

Customer Reviews

Great Services!

FMCSA Registration LLC has been a life-saver for my company. They ensure that my employees comply with all FMCSA regulations. We haven’t been fined or penalized in many years. And I owe that to the great folks at FMCSA Registration LLC. They are the only third-party registration service that I trust.

My organization has been securing DOT Numbers, MC Numbers, UCR Registration, and all other FMCSA requirements from FMCSA Registration LLC for well over a decade. Why? Their services are lightning-fast, their customer service is excellent, and they go the extra mile to make sure that we maintain full compliance at all times. A+++.

What Should I Have When Filing My IFTA Return?

Here is the key information that you will need to create your IFTA return. First, you must list your total mileage, both non-taxable and taxable. This includes trip permit miles. Next, calculate how many gallons of fuel you consumed. Once again, that number is both taxable and nontaxable. Then, write down how many miles you traveled within every member jurisdiction. Plus, the total gallons consumed inside each jurisdiction. But that’s not all. You must also write down the number of tax-paid gallons that you bought in a jurisdiction. Last but not least, write down the current tax rate of every member jurisdiction.

Why Was IFTA Created?

IFTA has one key purpose. It is to help each driver or carrier maintain a single fuel tax license. The license covers all qualified commercial vehicles in a fleet. Through IFTA, the vehicles gain operating authorization within all IFTA jurisdictions. This way, you will only need to file a single tax return every quarter. The filing will go through your base jurisdiction. The content of the IFTA filings focus on both mileage and fuel consumption.

Who Created IFTA? (The History of the International Fuel Tax Agreement)

1983 was the year that IFTA originated. Authorities in Arizona, Iowa, and Washington pushed its creation into existence. IFTA became based on the RFTA (Regional Fuel Tax Agreement). Maine, New Hampshire, and Vermont were RFTA-compliant states. So, why did RFTA and IFTA get created? Motor carriers were struggling to file dozens of state fuel tax filings at once. IFTA now simplifies the fuel tax reporting processes of most commercial carriers.

What Is the Formula for IFTA?

There is a simple method for calculating your traveled miles per IFTA state. Here is the formula. You divide total miles that you drove by the total gallons consumed. This way, you will know your exact fuel mileage. But wait. There's one more important notion to keep in mind. IFTA will allow you to round off the MPG to two decimal points.

Which States Are Not Included in IFTA?

Here are the US states (and districts) that IFTA does not include. They are: Alaska, Hawaii and also the District of Columbia (Washington D.C.). Three Canadian territories also do not take part in IFTA. These are: Yukon Territory, Northwest Territory and Nunavut.

The Meaning of “Base Jurisdiction”

The definition of a base jurisdiction is simple. It is the location where the information and vehicle of a carrier becomes registered. Say that an audit takes place in relation to your business. An audit will happen in your base jurisdiction. That's because your records of operations exist there.

Our IFTA Creation Services Go the Extra Mile

We know that you go the extra mile every day, both in your truck and to make a living. That's why FMCSAregistration.com team members also go the extra mile. We’re here to keep up with all your business registration needs. Our IFTA creation services focus on providing you with time-saving features. From accurate fuel tax calculations to pre-auditing help. We can even provide automatic IFTA report generation for your carrier.

Our experts understand how confusing making IFTA and IRP reports can seem. That's why our creation specialists are standing by. They're ready to provide US-based customer support right now. So, no matter how many miles you've racked up, you can count on us for registration.

The Basics of IFTA Reporting

Through IFTA, every motor carrier has to maintain detailed records about miles driven. But that's not all. Records must also include fuel purchases and the fuel tax amount paid within a state. This criteria focuses on carrier vehicles that operate within each IFTA jurisdiction. Your carrier has to file these records within its base jurisdiction. This needs to happen every single quarter.

A Base jurisdiction determines if a carrier owes taxes or should receive a credit. Of course, allocating taxes is a very complex process. That's why IFTA and IRP (International Registration Plan) officials work hard. They're on your side and want to make tax reporting processes simple for all carriers. Say that you have questions about IFTA reporting. Do not hesitate to contact our organization. Our creation team’s prepared to help you out at any moment.

More Information About the IFTA Process

Every US motor carrier has to file an IFTA license application. This filing process takes place within the base jurisdiction of a trucking business. Then, the base jurisdiction will review and process the licensing information. This way, the creation of an IFTA license can take place. Then, the carrier will receive two decals for every vehicle. A carrier has to place an IFTA license into each vehicle.

Say that a quarter comes to an end. A licensed carrier has to create and file the IFTA tax return. The filing will go through the base jurisdiction for processing. This filing will set the amount of fuel that the carrier used in the quarter. The base jurisdiction will review and process the IFTA tax return. Then, that jurisdiction sends information to other jurisdictions where the vehicle drove. Next, the base jurisdiction will process payments and reports from other IFTA states. It’s then up to the carrier to pay what's owed to the base jurisdiction. The base jurisdiction then takes care of paying all other involved jurisdictions.

IRP (International Registration Plan) vs. IFTA

Here is a common question that our organization receives. “Is IRP the same as IFTA?” The answer is no. IRP refers to the official International Registration Plan. IRP functions as an agreement involving vehicle registration for commercial carriers. Like IFTA, motor carriers have to register vehicles within their base jurisdictions. But instead of receiving decals, IRP-compliant carriers will get apportioned plates. Also, like IFTA, IRP is for commercial vehicles weighing over 26,000 pounds. Do you want to learn more about IRP? If so, please browse our IRP Creation page. Our experts are standing by to help you receive apportioned plates ASAP.

Questions About Our IFTA Creation Services? Call Us Now

We’re standing by to answer all your questions related to our IFTA creation services. Please give us a call right now to find out more information. You're also welcome to order IFTA creation over the phone. Then, our experts won't rest until you can receive the decals that you need. Our team looks forward to helping you set up important IFTA processes.